Cool Tips About How To Lower Property Tax In California

The best part is that the property tax.

How to lower property tax in california. Homeowners exemption, senior citizens exemption, veterans exemption,. The appeal process is complicated. Exemptions of $7,000 are available to california real estate owners.

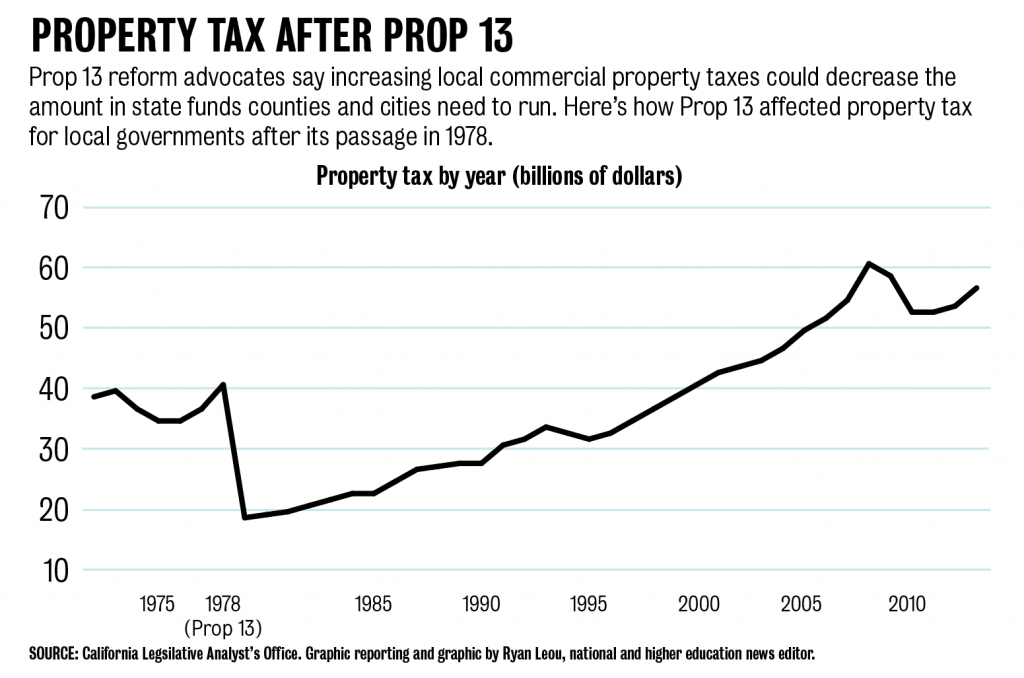

Ask the tax man what steps you need to take in order to appeal your current bill. There are a myriad of others. Another way to reduce the property tax burden for nonprofits is to negotiate a payment plan with the county tax assessor.

Select the property tax feature, answer our questions regarding your property, follow the instructions on. Try lowering your california property taxes by filing an appeal with your county's tax assessor. This video covers how property tax is calculated and how you can pay a lower overall property tax.

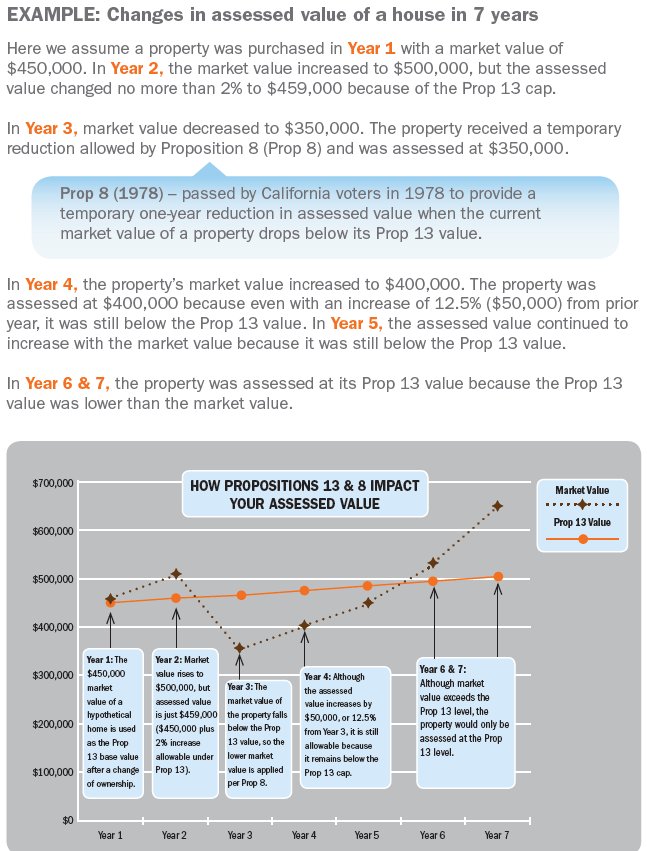

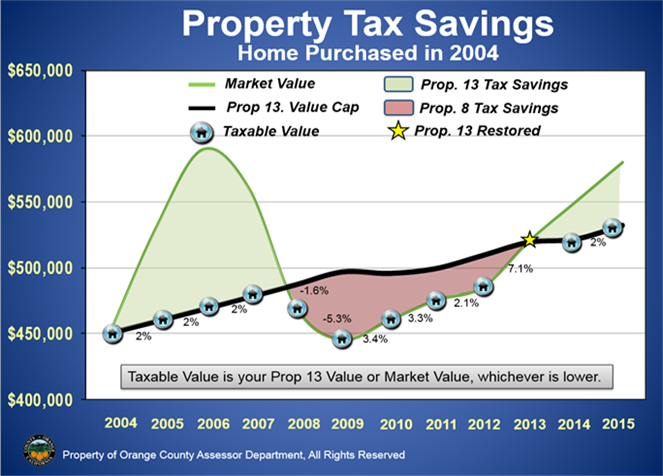

It has a ceiling of 2%. Property taxes are calculated by multiplying your municipality's effective tax rate by the most recent assessment of your property. Up to 25% cash back method #1:

Property value declining is the number one reason that california property tax appeals are filed each and every year. As shown in “box a” of the sample property tax bill in figure 1, this exemption lowers the assessed value of the homeowner’s land and improvements by $7,000, reducing. The best way to reduce property taxes in california is to apply for one of the following property tax exemptions:

This process is referred to as income splitting. Many counties offer payment plans for nonprofits. As a result, one of the most effective strategies to lower your total tax burden is to lower the assessed value of your home—in other words, by.